Arlington, TX Business Bankruptcy Lawyer

Leading You Through Bankruptcy With Confidence

If your company has been experiencing financial trouble, then you may want to speak with our Arlington, TX business bankruptcy lawyer for help. Bankruptcy is often viewed in a negative way, but it’s actually a resource for people and businesses alike that are going through severe monetary hardships. Understanding whether this option is right for your business can be difficult to assess on your own. Our team at Leinart Law Firm is glad to offer our insight and guidance as you prepare for the future. Bankruptcy can provide a fresh financial restart, ultimately putting someone on a path to more secure financial wellness. To talk with a member of our team, call us today for a free case evaluation.

Table of Contents

Filing For Business Bankruptcy

If your business is a corporation, LLC, or partnership, then your situation may be a little bit more complicated. Your company could be liquidated, where you sell your assets as a way to pay back your creditors.

It’s important to be aware of the pros and cons of filing for bankruptcy. We can answer your questions, address business concerns, and approach your situation with compassion.

After all, every business owner wants to thrive, so if you feel like that hasn’t been you lately, then it may be time to consider this valuable resource. Also, don’t get yourself down about difficult times with your business. The fact that you are assessing your options is a great thing.

The Types Of Business Bankruptcy

Our Arlington business bankruptcy attorney knows that financial difficulties can strike any business, regardless of its size or industry. When a business faces overwhelming debt and struggles to meet its financial obligations, bankruptcy may become a viable option.

Business bankruptcy is a legal process that allows struggling companies to reorganize or liquidate their assets to address their financial challenges. There are several types of business bankruptcy, each designed to meet specific needs and circumstances. The following is a brief overview.

Chapter 7 Bankruptcy: Liquidation

Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, is typically used when a business is unable to continue its operations and needs to cease its activities entirely.

In a Chapter 7 bankruptcy, a court-appointed trustee takes control of the business’s assets, sells them, and distributes the proceeds to the creditors. This process allows for the orderly and fair distribution of assets to satisfy outstanding debts. Once the assets are liquidated, and creditors are paid, any remaining debt is typically discharged, relieving the business of further financial obligations.

While Chapter 7 bankruptcy results in the closure of the business, it can provide business owners with a fresh start and relief from overwhelming debts. This option is most suitable for businesses with few remaining assets or those unable to generate sufficient income to continue operations.

Chapter 11 Bankruptcy: Reorganization

Chapter 11 bankruptcy is a more complex and flexible form of bankruptcy designed for businesses that want to continue operating while restructuring their finances. This type of bankruptcy allows businesses to create a plan for debt repayment, renegotiate contracts, and make changes to their operations to become financially viable again.

Under Chapter 11 bankruptcy, the business remains in control of its operations as a debtor-in-possession, subject to court supervision. The business develops a reorganization plan that outlines how it will repay its creditors over a specified period, often reducing the total amount owed or extending payment terms. Creditors then vote on the plan, and if approved, the business follows it to regain financial stability.

Chapter 11 bankruptcy is commonly used by larger corporations and businesses with significant assets or complex financial structures. It provides the opportunity to restructure debt, renegotiate leases, and continue operations with the goal of emerging from bankruptcy as a financially healthier entity.

Chapter 13 Bankruptcy: Reorganization For Small Businesses

Chapter 13 bankruptcy is a reorganization option designed primarily for individuals and sole proprietors, but it can also be used by small businesses that meet specific criteria. Unlike Chapter 11, Chapter 13 is generally more streamlined and less expensive, making it a practical choice for small businesses.

In a Chapter 13 bankruptcy, the business owner creates a repayment plan outlining how they will repay their debts over a three- to five-year period. The plan must be approved by the court and should prioritize the payment of secured debts, such as mortgages or car loans, while unsecured debts may be partially or fully discharged.

Chapter 13 allows small business owners to retain control of their operations while addressing their financial challenges through a structured repayment plan. This type of bankruptcy is suitable for businesses that have a consistent source of income and are capable of repaying their debts over time.

Choosing The Right Type Of Bankruptcy

The type of business bankruptcy that is most appropriate for a particular situation depends on factors such as the company’s size, financial condition, and objectives. Determining the best course of action often requires a thorough evaluation of the business’s financial status and consultation with our business bankruptcy lawyer in Arlington, Texas.

It’s essential for businesses facing financial distress to seek legal counsel to assess their options and navigate the complexities of bankruptcy law. With the right guidance, businesses can choose the most suitable bankruptcy option to address their financial challenges and work toward a more stable and prosperous future. Contact our attorneys at Leinart Law Firm to find out how we can help.

Important Factors In The Business Bankruptcy Process

Facing financial challenges as a business owner can be overwhelming. Our Arlington bankruptcy lawyer at Leinart Law Firm is here to provide guidance and support. Below, we offer key insights into the realm of business bankruptcy, helping you make informed decisions during challenging times.

Assessing The Financial Landscape: The first step in addressing business bankruptcy is a thorough assessment of your financial situation. Leinart Law Firm has ample experience in helping Arlington businesses evaluate their financial health, identifying viable options, and creating a strategic plan tailored to your unique circumstances.

The Importance Of Timely Action: Acting promptly is crucial when considering business bankruptcy. Leinart Law Firm encourages proactive measures to address financial challenges, exploring alternatives to bankruptcy when possible and ensuring timely initiation of the bankruptcy process when needed.

Protecting Personal Assets: As a business owner, protecting personal assets is a significant concern during bankruptcy. An Arlington business bankruptcy lawyer provides strategic advice on separating business and personal assets, minimizing personal liability, and navigating the legal nuances to safeguard your financial interests.

Negotiating With Creditors: Leinart Law Firm excels in negotiating with creditors on behalf of clients facing bankruptcy. Our experienced team works to reach agreements that are favorable to your business, aiming for debt reductions, extended payment terms, or other arrangements that align with your financial goals.

Understanding The Automatic Stay: Filing for bankruptcy triggers an automatic stay, halting creditor actions such as contacting about owed debts. Leinart Law Firm ensures that businesses fully understand the protective aspects of the automatic stay, providing a breathing space to reorganize and strategize.

Developing A Reorganization Plan: For businesses opting for Chapter 11 bankruptcy, Leinart Law Firm assists in developing comprehensive reorganization plans. These plans outline how the business will operate post-bankruptcy, addressing debt repayment, renegotiating contracts, and ensuring a sustainable financial future.

Guidance Through The Bankruptcy Process: Leinart Law Firm is committed to providing hands-on guidance through every step of the bankruptcy process. Our attorneys demystify the legal complexities, keep you informed, and act as your advocates to achieve the best possible outcomes for your business.

Collaborative Approach: Leinart Law Firm takes a collaborative approach to business bankruptcy cases. We work closely with our clients, understanding their business goals, and developing strategies that align with their long-term objectives. Our goal is to provide comprehensive and personalized legal assistance.

In challenging financial times, having a dedicated legal team on your side can make a significant difference. Leinart Law Firm is here to guide Texas businesses through the process of business bankruptcy, offering support and guidance every step of the way. Contact us today for a confidential consultation from our Arlington business bankruptcy lawyers.

Arlington Business Bankruptcy Infographic

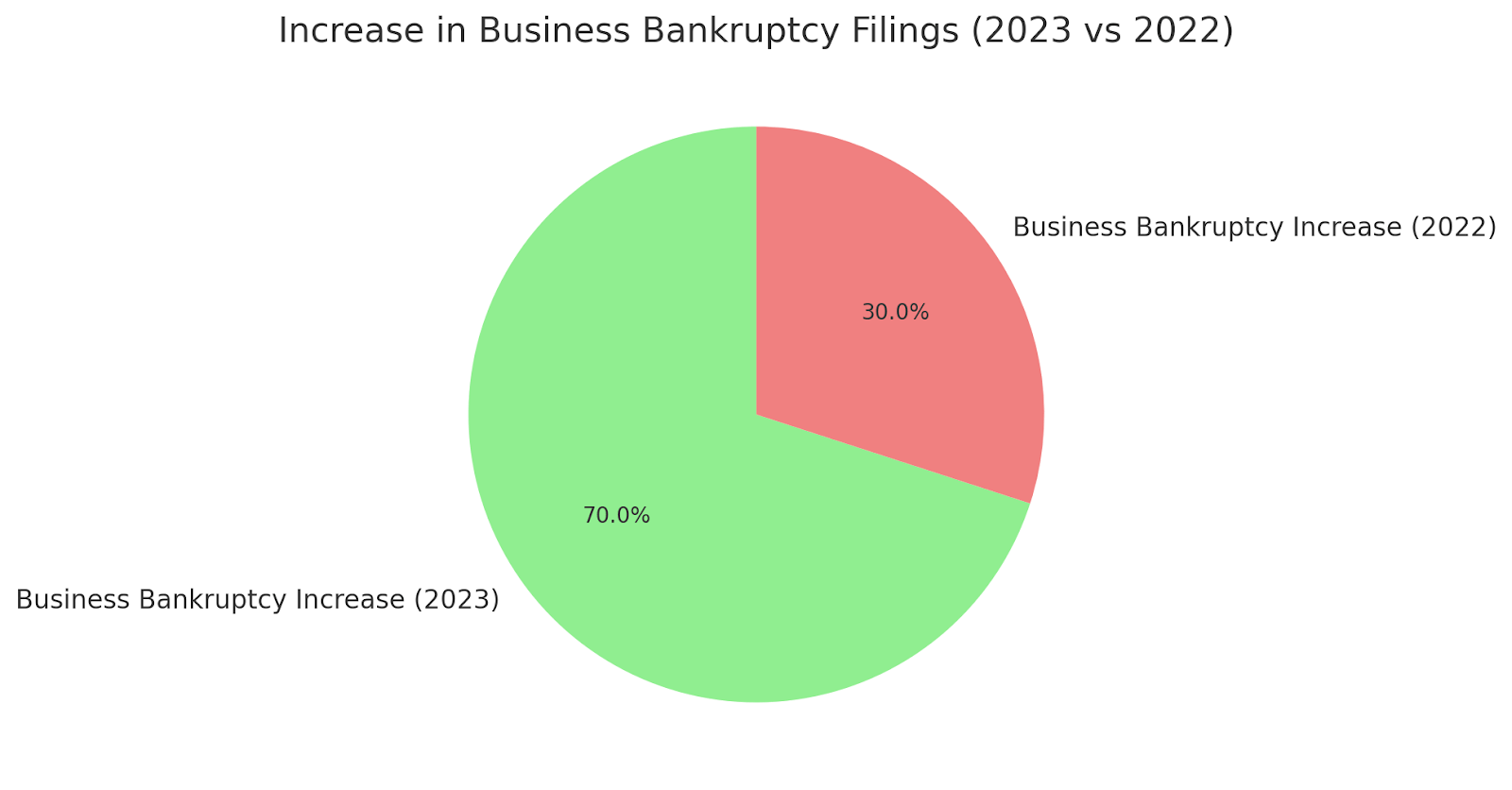

Arlington Business Bankruptcy Statistics

According to national statistics, business bankruptcy filings are up almost 70 percent from last year. If your business is struggling financially, there may be steps you can take to save it. Call our office today to speak with a skilled Arlington business bankruptcy lawyer to find out what legal options you may have to protect yourself financially.

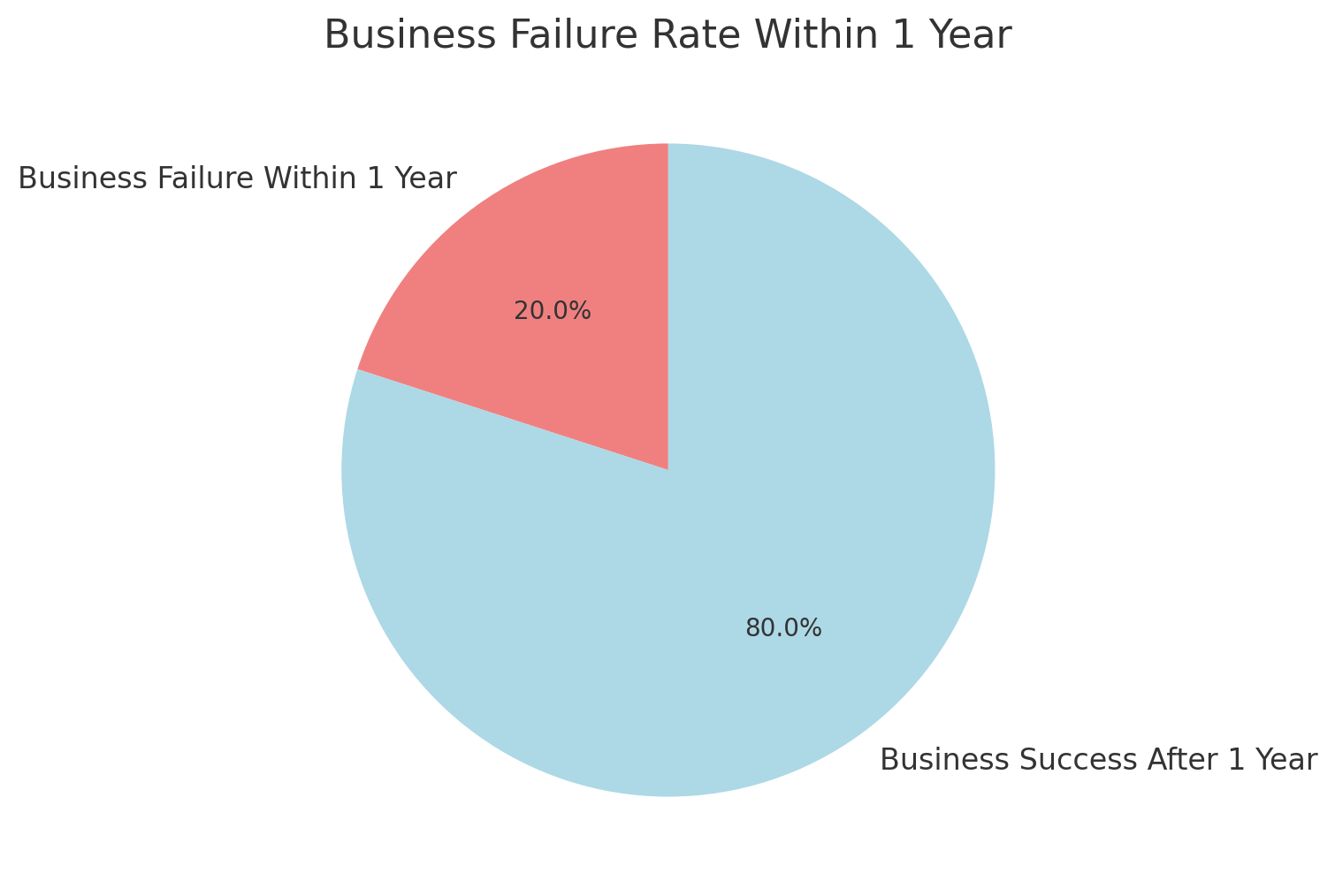

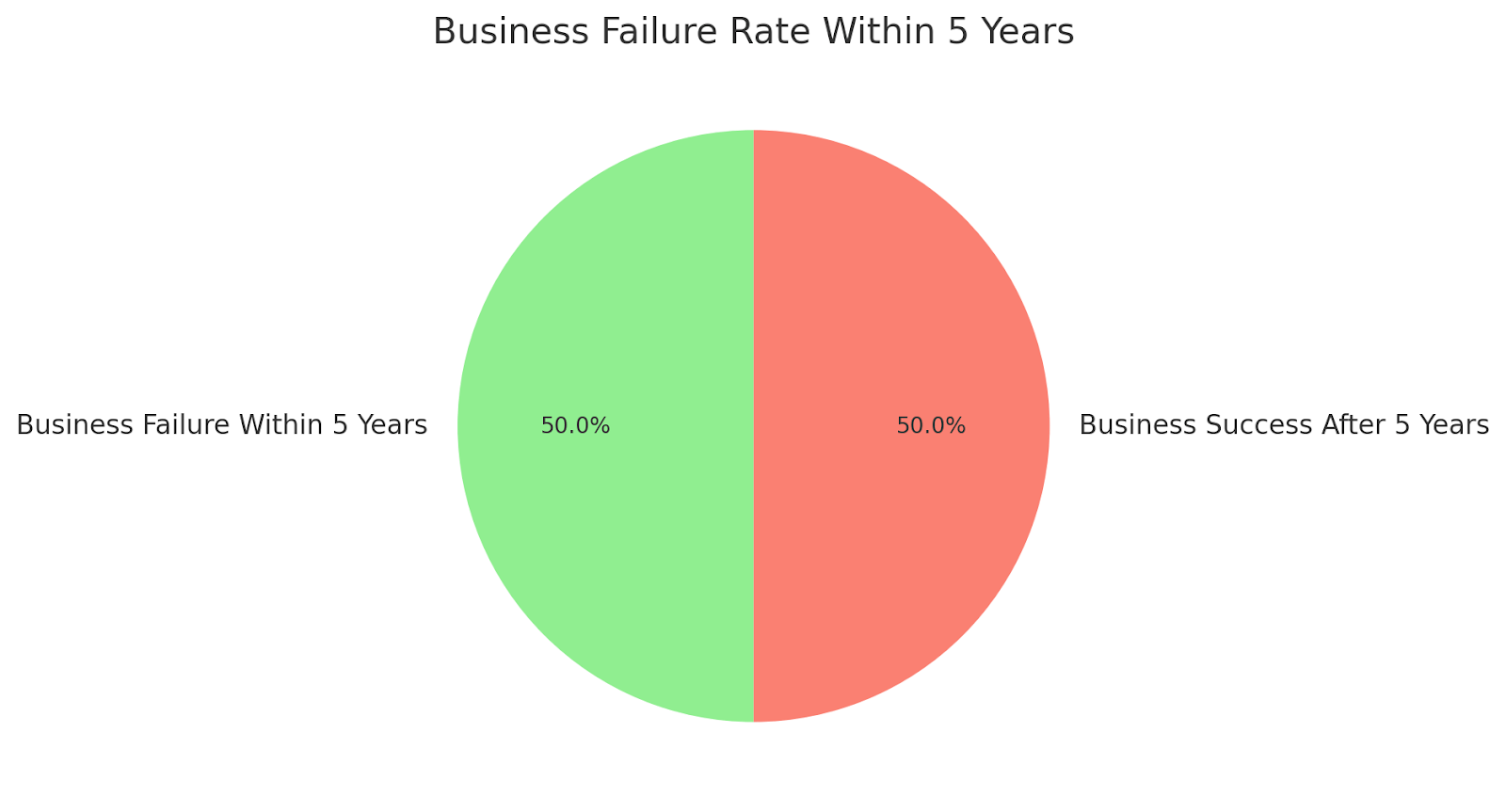

According to a report by the U.S. Bureau of Labor Statistics, approximately 20% of new businesses fail within the first year, and about 50% of businesses fail within five years. This emphasizes the challenges faced by new and small businesses, underscoring the need for strategic planning, proper financial management, and, sometimes, external professional guidance.

Business Bankruptcy FAQs

What Is A Business Bankruptcy Lawyer, And What Do They Do?

A business bankruptcy lawyer is a legal professional who provides assistance to businesses facing financial distress or insolvency. We are well-versed in bankruptcy laws and are crucial in helping businesses through the legal processes associated with filing for bankruptcy.

When Should A Business Consider Hiring A Bankruptcy Lawyer?

A business should consider hiring a bankruptcy lawyer when facing financial difficulties that may jeopardize its ability to meet financial obligations. Signs may include consistent cash flow problems, mounting debts, legal actions from creditors, and an overall inability to sustain regular business operations.

Can A Business Continue Its Operations During Bankruptcy?

Yes, under Chapter 11 bankruptcy, a business can continue its operations while developing a plan to restructure and repay debts. The court must approve the reorganization plan, and the business operates under its guidance.

How Do Bankruptcy Lawyers Negotiate With Creditors?

A business bankruptcy lawyer negotiates with creditors to reach agreements on debt repayment terms, interest rates, and sometimes, a reduction in the overall debt amount. Our goal is to find a mutually beneficial arrangement that allows the business to recover while addressing the concerns of creditors.

What Are The Potential Outcomes Of A Business Bankruptcy Case?

The outcomes of a bankruptcy case vary depending on the type of bankruptcy filed. In Chapter 7, the business may cease operations, and assets are liquidated to pay off creditors. In Chapter 11, the business continues operations under a court-approved plan. Chapter 13, while primarily for individuals, can be used by sole proprietorships to establish a repayment plan.

How Long Does The Business Bankruptcy Process Typically Take?

The duration of a business bankruptcy case varies, but it generally takes several months to years. Chapter 7 cases are typically resolved more quickly, while Chapter 11 cases, involving reorganization, can take longer due to the complexity of the process.

Arlington Business Bankruptcy Glossary

Our Arlington business bankruptcy lawyer at Leinart Law Firm has over fifteen years of experience helping companies determine the best course of action, whether through liquidation or restructuring, while ensuring compliance with bankruptcy regulations.

Navigating business bankruptcy requires an understanding of key legal terms and concepts that dictate how financial distress is managed under the law. Below are five crucial terms often encountered in business bankruptcy cases:

Chapter 7 Bankruptcy

This is a liquidation process where a business ceases operations, and its assets are sold to pay off creditors. It is often chosen when a company has no viable future and cannot sustain operations. A court-appointed trustee oversees the sale of assets and distributes the proceeds to creditors according to a legal priority system.

Secured creditors, such as banks with liens on property, are paid first, followed by unsecured creditors like suppliers and customers. Once the process is complete, most debts are discharged, meaning the business is no longer liable for them. However, Chapter 7 does not protect business owners from personal liability if they have personally guaranteed business debts.

Chapter 11 Bankruptcy

Known as reorganization bankruptcy, Chapter 11 allows businesses to continue operations while restructuring their debts. It is commonly used by corporations, partnerships, and sole proprietorships that wish to remain in business but need financial relief. The debtor proposes a plan outlining how it will pay creditors over time, potentially reducing the total debt amount, extending payment timelines, or renegotiating contracts.

This process is complex and requires court approval, with input from creditors who may vote on the plan. A company under Chapter 11 continues operating under the oversight of the bankruptcy court, which ensures compliance with the reorganization plan and protects the rights of creditors.

Automatic Stay

An automatic stay is a powerful legal protection that immediately goes into effect when a business files for bankruptcy. It halts most collection activities, including lawsuits, foreclosures, repossessions, wage garnishments, and creditor harassment.

Our skilled Texas bankruptcy lawyer knows that this stay gives the debtor time to assess its financial situation and develop a strategy for moving forward, whether through liquidation or restructuring. However, creditors may petition the court to lift the stay under certain circumstances, such as when a secured creditor wants to recover collateral. The stay remains in effect until the bankruptcy case is dismissed, discharged, or converted to another chapter.

Debtor In Possession (DIP)

In Chapter 11 bankruptcy, the business filing for bankruptcy typically continues operating as a Debtor in Possession (DIP) rather than being replaced by a court-appointed trustee. The DIP retains control over the business and its assets, but it must act in the best interests of creditors and follow strict court guidelines.

The company must submit financial reports, seek court approval for major business decisions, and adhere to the reorganization plan. DIP financing, which allows businesses to secure new loans while under bankruptcy protection, is often crucial for sustaining operations. If the debtor fails to comply with court rules or mismanages assets, the court may appoint a trustee to take over.

Bankruptcy Estate

When a business files for bankruptcy, all its assets and property interests become part of the bankruptcy estate, which is managed under court supervision. This includes tangible assets such as buildings, equipment, and inventory, as well as intangible assets like patents, trademarks, and accounts receivable.

The bankruptcy estate is used to satisfy outstanding debts according to legal priority rules. In Chapter 7 cases, the estate is liquidated, with proceeds distributed to creditors. In Chapter 11 cases, the estate remains under the debtor’s control but must be managed in compliance with the reorganization plan. The court may also scrutinize recent asset transfers to determine whether they were fraudulent or unfairly benefited certain creditors.

Contact Our Bankruptcy Attorneys Today

You do not have to struggle with your business finances alone. There are dedicated professionals who empathize with what you are going through, and can offer some solutions. Our team at Leinart Law Firm can help you create a plan to eradicate debts and get your financial stability back on track. We are ready to offer support, so contact our Arlington bankruptcy attorneys today.

Client Review

“Everything has been real good so far in our bankruptcy case I’m from out of town so they where good about handling stuff out of office that we could online phone etc correspondence was good got right back to you when you contacted Them .”

Alan Farmer

Dallas & Plano office

10670 N Central Expwy

Suite 320

Dallas, TX 75231

(469) 214 6276

Fort Worth Office

5601 Bridge St

Suite 400

Fort Worth, TX 76112

(469) 214 6276

Location Served:

Arlington, TX

Denton, TX

Garland, TX

Grand Prairie, TX

Irving, TX

McKinney TX